In today’s fast-paced insurance industry, accurate and timely property assessments are critical for efficient claims processing. Insurance adjusters often face the challenge of inspecting roofs after events like storms, hurricanes, or hail damage, where speed and accuracy are paramount. Traditional roof inspection methods can be time-consuming, costly, and occasionally unsafe due to precarious conditions. This is where aerial roof measurements come into play. Leveraging satellite and drone technology, aerial roof measurements offer a game-changing solution that not only saves time but also improves accuracy and safety. Here’s a deep dive into how aerial roof measurements are transforming the insurance claims process.

1. Reducing Time and Costs in Claims Processing

One of the biggest challenges for insurance adjusters is completing timely, cost-effective roof inspections. Conventional inspections require adjusters to physically access the property, set up ladders, measure roof dimensions, and record conditions. This manual process is labor-intensive and can take hours or even days, especially if multiple properties are involved.

Aerial roof measurements streamline this process by providing precise measurements from satellite imagery or drones. Insurance adjusters can access roof dimensions, slope, pitch, and condition data within minutes, without the need for on-site visits. This reduction in travel time and manpower not only speeds up the claims process but also significantly lowers operational costs for insurance companies.

2. Enhanced Accuracy and Data Quality

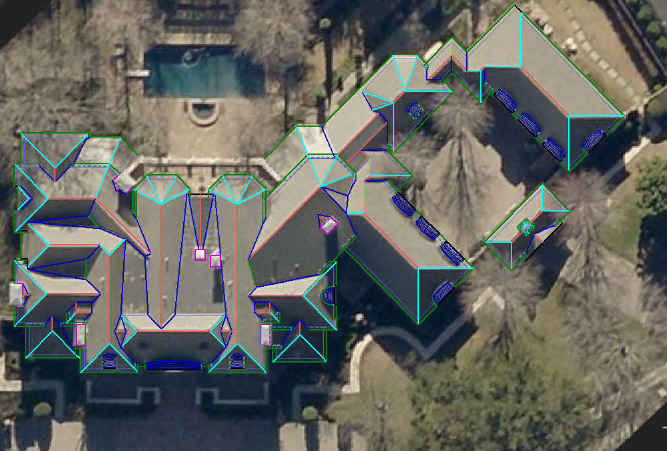

Accuracy in roof measurement is crucial, as even small errors can lead to costly claims disputes or inaccuracies in coverage assessments. Traditional measurement methods rely on manual calculations, which are prone to human error. Aerial roof measurements, however, use advanced imaging technology that captures highly accurate data on roof dimensions and conditions.

Modern aerial measurement platforms employ cutting-edge algorithms and 3D modeling software, which generate comprehensive roof reports with precise measurements down to millimeter accuracy. With accurate data, insurance adjusters can assess damage more reliably and provide fair claim settlements, ensuring both client satisfaction and company profitability.

3. Improving Safety for Adjusters

Roof inspections carry inherent risks, especially when adjusters must climb damaged, steep, or slippery roofs. These dangers are amplified after severe weather events, when roofs may have structural weaknesses, loose shingles, or even collapse risks. By using aerial roof measurements, adjusters can avoid these risks altogether.

Drones and satellite technology allow adjusters to inspect roofs remotely, collecting high-resolution images and accurate measurements without putting themselves in harm’s way. This increased focus on adjuster safety not only reduces workplace injuries but also minimizes liability for insurance companies, which can face high costs due to workplace accidents.

4. Faster Response After Natural Disasters

After natural disasters, insurance companies face a surge in claims, and adjusters are often overwhelmed with requests. Aerial roof measurements provide a rapid solution to handle high volumes of claims effectively. Drones and satellites can capture images of affected areas immediately after the disaster, allowing insurance companies to assess the extent of damage without delays.

This rapid response capability is crucial for policyholders who need quick assistance after events like hurricanes or wildfires. The faster an adjuster can process a claim, the sooner homeowners can start repairs, improving customer satisfaction and retention rates. In large-scale catastrophes, this efficiency can also support community recovery efforts by enabling quicker restoration of homes and businesses.

5. Reducing Disputes Through Objective Data

Insurance claims often involve disputes over the extent of roof damage, especially when substantial repair or replacement costs are at stake. With traditional inspections, adjusters may face disagreements with homeowners or contractors about the damage severity. Aerial roof measurements provide objective, detailed data that reduces the likelihood of disputes.

High-resolution aerial imagery captures a roof’s current state with precision, allowing adjusters to present clear, irrefutable evidence. Insurance companies can use this data to justify claim decisions, ensuring transparency and fostering trust between clients and adjusters. This objective approach not only streamlines claims processing but also helps avoid legal disputes and reduces claim settlement times.

6. Supporting Remote Claims Management

Remote claims management has gained traction as insurance companies adopt digital solutions to improve efficiency. Aerial roof measurements fit seamlessly into remote claims workflows, enabling adjusters to handle claims without being physically present at each property.

Remote claims management allows adjusters to review roof conditions, analyze measurements, and generate reports from a central location. This capability is especially valuable for insurance companies managing claims across wide geographic areas, reducing travel costs and enhancing scalability. As a result, companies can handle more claims in less time, improving productivity and service levels.

7. Integrating with Claims Software for Streamlined Processing

Today’s aerial measurement solutions integrate with advanced claims management software, allowing adjusters to access roof data directly within their digital systems. This integration means adjusters can pull aerial data into claim files, view roof images, and complete evaluations without switching between platforms.

Automating data transfer between aerial measurement tools and claims software reduces manual data entry, minimizing errors and enhancing operational efficiency. By streamlining these processes, insurance companies can accelerate claims workflows, reduce administrative costs, and enhance data security through centralized digital records.

8. Environmentally Friendly Solution

Aerial roof measurements also present an eco-friendly alternative to traditional inspection methods. By reducing the need for vehicle travel and minimizing the number of on-site inspections, insurance companies can reduce their carbon footprint. Drones and satellites can capture data remotely, lessening the environmental impact associated with claims processing.

For insurance companies focused on sustainability, this shift can be a valuable step toward greener practices. Customers are increasingly aware of environmental concerns, and companies that adopt eco-friendly practices often benefit from enhanced brand reputation and customer loyalty.

9. Building Customer Trust Through Technology and Transparency

Customers want to know that their claims are handled fairly and efficiently. By using aerial roof measurements, insurance companies demonstrate a commitment to precision, transparency, and timely service. These modern technologies allow adjusters to provide homeowners with clear documentation and quick responses, strengthening customer trust.

In an industry where customer satisfaction drives retention, technology-backed services like aerial roof measurements add value for policyholders. By showing clients how aerial measurements enhance accuracy and fairness, insurance companies can build lasting relationships and improve brand loyalty.

Conclusion

Aerial roof measurements have transformed the insurance industry by providing fast, accurate, and safe alternatives to traditional roof inspections. Insurance adjusters now have access to objective data, enhanced accuracy, and remote capabilities that allow them to process claims efficiently and securely. From reducing time and costs to improving customer trust, the benefits of aerial measurements are undeniable. As the technology behind aerial roof measurements continues to advance, it’s likely that even more applications will emerge, making this an essential tool for forward-thinking insurance companies.